Money management wasn’t always my strong suit. Like many people, I used to wonder where my salary went each month. My expenses seemed small, coffee here, online shopping there, but by payday, my wallet was empty. That’s when I realized I needed a smarter way to track my spending and save intentionally.

Fast forward to 2025, I’ve tested and compared several budgeting apps that helped me gain control over my finances. In this guide, I’ll share the best budget apps to track your expenses in 2025, the ones that truly make a difference.

Whether you’re trying to save for travel, pay off debt, or simply understand your spending habits, there’s an app here that can help.

Why You Need a Budgeting App in 2025

The world is moving fast. Online shopping, digital wallets, and subscriptions make spending effortless, but also harder to track. Budgeting apps give you visibility and control over where your money goes.

Here’s Why They’re Worth Using:

- Automation: No more manually jotting expenses on paper or spreadsheets.

- Real-time insights: See exactly how much you spend on food, bills, or shopping.

- Goal tracking: Set savings goals and get reminders to stay on track.

- Multi-currency support: Great for freelancers or digital nomads earning in different currencies.

- Financial awareness: Helps reduce impulse spending by showing the bigger picture.

Who These Apps Are For

I’ve found budgeting apps helpful for all kinds of people, because managing money is universal.

These apps are perfect for:

- Students trying to stretch their allowance or part-time income.

- Young professionals balancing bills, rent, and fun money.

- Parents tracking household budgets and family expenses.

- Freelancers or entrepreneurs monitoring irregular income and taxes.

- Anyone who wants financial peace of mind.

If you’ve ever said, “Where did my money go?”, this article is definitely for you.

What Makes a Great Budget App

When evaluating apps, I used six main criteria to find the best options for 2025:

- Ease of use – A clean interface that makes expense tracking quick.

- Automation – Bank sync, receipt scanning, or AI categorization.

- Customization – Ability to create your own budget categories.

- Security – Data encryption and privacy controls.

- Cross-platform access – Available on Android, iOS, and web.

- Affordability – Free or reasonably priced plans.

The Best Budget Apps to Track Your Expenses in 2025

Here are the top apps I’ve personally tried and recommend, based on how they perform in real-world daily budgeting.

1. Mint by Intuit (Best for Overall Budget Management)

What It Is:

Mint has been a household name in personal finance for years, and it keeps improving. It automatically tracks your transactions, categorizes them, and gives you a real-time view of your budget.

Why I Use It:

It’s like having a financial assistant. Once I connected my bank and credit cards, Mint did all the work, no more manual input.

Key Features:

- Automatic expense categorization

- Credit score monitoring

- Bill reminders and alerts

- Trend reports and graphs

Pros:

- Completely free

- Syncs across all devices

- Intuitive dashboard

Cons:

- Occasional ads

- Bank syncing can lag

2. YNAB (You Need a Budget) – Best for Goal-Oriented Budgeters

What It Is:

YNAB uses a proactive budgeting philosophy: you give every dollar a job. Instead of tracking what you spent, it helps you plan how to spend your money intentionally.

Why I Recommend It:

This app changed my mindset. I stopped reacting to expenses and started planning for them.

Key Features:

- Goal setting and progress tracking

- Syncs bank accounts and cards

- Debt payoff planner

- Community and workshops for financial literacy

Pros:

- Empowers proactive saving

- Excellent support and tutorials

- Real results for consistent users

Cons:

- Paid plan ($14.99/month after free trial)

- Steeper learning curve for beginners

3. Goodbudget – Best for Couples and Shared Budgets

What It Is:

Goodbudget is based on the classic envelope budgeting system, digitalized. You set spending categories (envelopes) and allocate amounts for each.

Why I Use It for Family Budgeting:

It’s perfect for couples like me and my partner, who want transparency in shared expenses.

Key Features:

- Shared accounts for two users

- Manual entry or CSV import

- Expense breakdowns by category

- Debt payoff tracking

Pros:

- Great for shared budgeting

- Works without bank connection

- Simple and light

Cons:

- Manual updates can be tedious

- Limited free envelopes

4. PocketGuard – Best for Preventing Overspending

What It Is:

PocketGuard focuses on what you can safely spend after accounting for bills, savings, and goals.

Why I Like It:

It instantly shows how much “safe-to-spend” money I have for the week. That visual cue helps me avoid impulse buys.

Key Features:

- Bank syncing and auto categorization

- “In My Pocket” safe-to-spend tracker

- Spending limit alerts

- Subscription tracking

Pros:

- Smart and automated

- Visual spending summaries

- Ideal for beginners

Cons:

- Free version has limited customization

- Ads in the free plan

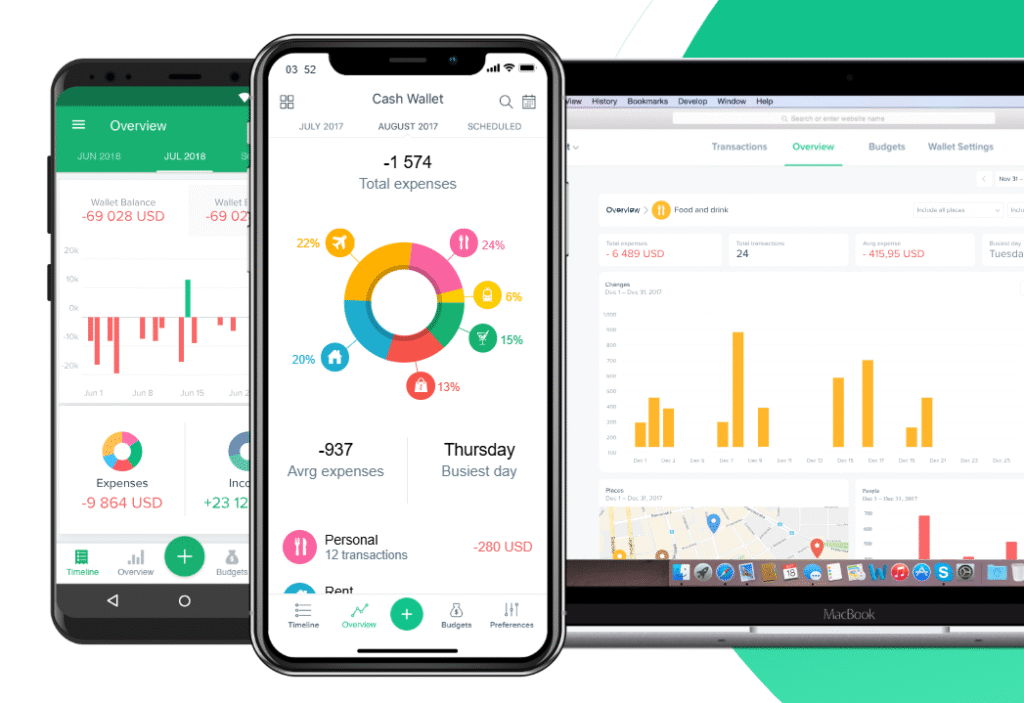

5. Spendee – Best for Visual Budgeters

What It Is:

Spendee turns budgeting into a colorful visual experience. You can connect your accounts or manually input expenses, then view detailed charts.

Why It Works for Me:

I’m a visual learner. Seeing pie charts and graphs helped me understand where my money went instantly.

Key Features:

- Wallets for personal, family, or travel use

- Multiple currency support

- Expense graphs and reports

- Budget reminders

Pros:

- Gorgeous design

- Easy to navigate

- Works well offline

Cons:

- Some features require premium

- No investment tracking

6. Wally – Best for International Users and Multi-Currency Budgets

What It Is:

Wally is a global finance tracker perfect for travelers, freelancers, or anyone managing multiple currencies.

Why I Love It:

I used Wally during a trip abroad, it tracked my expenses in both USD and local currency, automatically converting rates.

Key Features:

- Supports 200+ currencies

- Bank syncing in multiple countries

- Shared wallets for groups

- Detailed spending analytics

Pros:

- Perfect for global users

- Detailed insights

- Secure and user-friendly

Cons:

- Setup can take time

- Limited customer support

When and How to Use Budget Apps Effectively

I’ve learned that downloading a budgeting app isn’t enough, you need to use it consistently.

Here’s what works for me:

- Set aside 10 minutes daily to check and categorize expenses.

- Set clear goals: saving ₱10,000 or paying off a credit card.

- Review weekly: see what categories need adjustment.

- Turn on notifications for bill reminders and overspending alerts.

- Use visual dashboards, seeing your progress motivates you.

Where to Download These Apps

All the apps mentioned are available on:

- Google Play Store (for Android users)

- Apple App Store (for iPhone/iPad users)

- Official websites for desktop versions

Always ensure you download from official sources to protect your financial data.

Why Budget Apps Matter More Than Ever in 2025

With the rising cost of living and digital spending habits, financial awareness is crucial. Budget apps act like a personal accountant in your pocket, giving you data, reminders, and motivation to stay disciplined.

They’re not just tools for saving money, they’re tools for building habits.

I can confidently say that tracking my expenses transformed how I see money. Instead of feeling anxious about finances, I feel in control and empowered.

Using a budgeting app changed how I live. It’s not about restricting yourself, it’s about awareness. Once you see your spending patterns, saving becomes natural.

So if you’re tired of wondering where your money goes, start with any of these best budget apps for 2025. With a few taps each day, you’ll be on your way to smarter, stress-free financial living.